At the heart of a good investment in luxury cars

lie three fundamental pillars:

- Financial returns

- Rarity

- Character

A fine balance between financial and emotional returns

In the automotive world, it is often said that a car is one of the least profitable investments. The general perception is that popular supercars depreciate between 10-15% in their first year, while in the case of rare supercars, this depreciation can even reach 20 or even 30%. However, this is not true for every car.

Investing in supercars requires keen insight and a thorough knowledge of the market. It is a challenge where both financial and emotional returns beckon for the true connoisseur. But for those who manage to unravel this particular niche in the car market, a world of potentially valuable treasures opens up.

The foundation of a good investment

At the heart of a good investment in luxury cars

lie three fundamental pillars:

At Louwman Exclusive, we understand that true value goes beyond mere financial gain. It is about owning something exceptional, something that not only appreciates in a financial sense, but also holds a unique place in automotive history.

Rarity plays a crucial role here; cars produced in limited editions carry an exclusivity that sets them apart in a sea of mass production in the case of the Porsche 911, for example. But above all, it is the character of a car – its story, its heritage, and its unique features – that creates a deep emotional connection. This is what transforms a luxury car from simple possession to a covetable treasure, an investment that enriches the soul as well as the wallet.

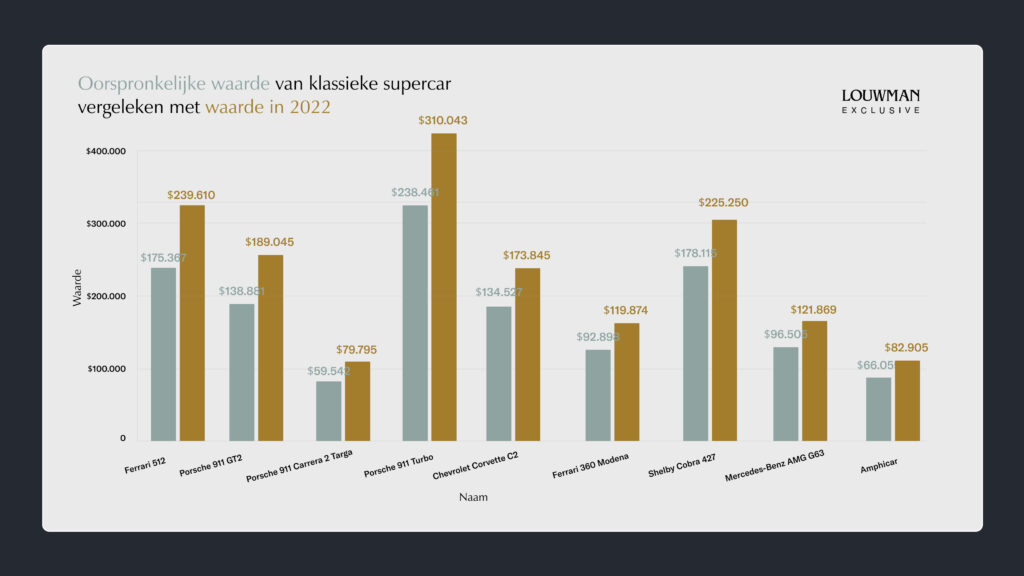

Like fishing, investing in cars has its fair share of stories about ‘the great one that got away’; classic models that get lost from sight, but are rediscovered years later by collectors and turn out to be worth a multiple. While the S&P 500 index, whose broad composition gives a reliable picture of developments in the US stock market, fell 19.4%, investing in certain classic cars did turn out to yield returns.

Ferrari 512 (1991-1996)

Take the 1991-1996 Ferrari 512, for example, which stood out with a 37% increase in value to $239,610.

Porsche 911 GT2 (2001-2004)

The Porsche 911 GT2, produced between 2001 and 2004, saw an equally impressive 37% rise, resulting in a new value of $189,045.

Porsche 911 Carrera 2 Targa (1990-1994)

The elegance of the Porsche 911 Carrera 2 Targa (1990-1994) was also noted, with a 34% increase in value to $79 ,795.

Porsche 911 Turbo (1993-1994)

Similarly, the Porsche 911 Turbo (1993-1994) increased its value by 30%, increasing its market value to $310,043.

Chevrolet Corvette C2 (1963)

The iconic 1963 Chevrolet Corvette C2, a masterpiece of American design, saw its value increase by 29% to $173,845.

Ferrari 360 Modena (1999-2004)

The Ferrari 360 Modena (1999-2004) recorded 29% growth, resulting in a final value of $119,874.

Among the more unique investments we find the Shelby Cobra 427, which experienced a respectable 26% increase, to reach a value of $225,250. The Mercedes-Benz AMG G63 experienced an equivalent increase of 26%, pushing its value up to $121,869. A true curiosity in the list is the Amphicar, a vehicle equally at home on water and on land, with a 26% increase in value to $82,905.

In the world of exclusive cars, Hagerty’ s 2024 Bull Market List symbolises unique opportunities that both set the collector’s heart racing and appeal to the savvy investor. This year’s list highlights some notable cars whose value is expected to rise, an opportunity you don’t want to miss.

The 1989 Lamborghini Countach 25th Anniversary is a true legend in the world of classic supercars. The supercar, whose name refers to the birth of Lamborghini in 1963, is distinguished by its breathtaking design and the power of its majestic V12 engine. Together, they embody the pinnacle of technical and aesthetic perfection.

With its price range of $345,000 to $770,000, depending on condition and unique features, this Lamborghini symbolises the ultimate in luxury and exclusivity, a vehicle that combines the true essence of speed and beauty. The Countach is not just an investment in a financial sense; it is an investment in a piece of history, an iconic symbol that has stood the test of time and will only become more valuable.

In addition, Hagerty’s estimates show that investing in unique vehicles such as the Porsche 997.2 GT3 RS 4.0, with an expected increase in value of 28% to £520,000, the Maserati Indy, with a growth of 22% to £64,000, and the Alvis Speed 20/25, with a solid increase of 15% to £90,000, can be very lucrative. These cars stand out not only for their mechanical superiority and historical value, but also for their rarity and aesthetic appeal, making them a smart choice for the investor with an eye for specialness and quality.

If your interest lies in investing in cars with both a fascinating history and promise for future appreciation, these models are undoubtedly worthy of your attention. At Louwman Exclusive, we not only offer access to an exceptional range of investment-worthy cars, but also the expertise to guide you in making the right choice. Whether you are charmed by a car’s speed and power or its rarity and class, our team is ready to advise and support you in your investment.

Your passion for cars and your desire for a smart investment will find a perfect match with us. Let’s invest together with Vision.